On 25 November 2025, the Turgot club, represented by J-J.Pluchart, was invited by the Cerfrance network to lead a conference-debate on the current challenges of AI for productive companies and professional associations. The Cerfrance organisation brings together 700 agencies, 14,000 experts and 320,000 clients “committed to economic, human and sustainable performance”. After having retraced the cycles of development of AI, successively “weak” then “strong”, the functionalities and the trades generated by AI were analysed. The AI “technology stack” now comprises three layers: systemic AI (semiconductors, networks, data centres), functional AI (recognition, data management, processing, storage, security), and agentic AI (Text: translations, article writing, summaries, scripts, automatic responses; Image: artistic creation, graphic design, illustrations; Video and audio: generation of synthetic voices, music, animations; Code: programming assistance, generation of scripts or functions). More and more sectors of activity must adapt their work organisation, in particular health, defence, banking and insurance, cybersecurity, industrial production (cobotics), mobility, publishing, cinema and media, education, research, programming, etc. Strategic functions, crisis management and local services are a priori spared. The adaptation proposals formulated in the reports of Villani (2018), Draghi and Letta (2023), Aghion-Bouverot (2024) and the AI Summit of February 2025 (AI “power lever”) were presented. The issues raised by the development of AI were then discussed: AI and national sovereignty, the contribution of AI to productivity and economic growth, the impact of data centres on GHG emissions, the financing of investments in AI R&D, the profitability of general AI models, the AI “stock market bubble”, the destruction and transformation of jobs, the dominant positions and cooperation agreements of GAFAM, the ethical codes of AI… It appears that the legal problems differ according to the phases of the process of value creation by AI: the collection of data by AI agents, learning by reinforcement models and the exploitation of applications thanks to user questions (prompts). The conference also focused on the general and specific biases of AI models: technical and psychological biases (perceptual, emotional and cognitive), specific biases of generative AI (related to linguistic disparities and implicit character), voluntary biases (simulations, manipulations, falsifications, intrusions)*. The presentation was concluded with a reflection on the strategies to be implemented in order to transform AI into a competitive advantage, and in particular, on the new approaches to ‘augmented management’, the integration of management systems, the audit of ‘high AI quotient’ functions, new decision-making aids, benchmarking actions, nudging, assistance with quotes (Relief) and troubleshooting, quality control, cybersecurity, and training in AI and ethics. The conference was illustrated by use cases and references to the works and reports chronicled on clubturgot.com and analysed in the last book of the Turgot cub: New reflections on the wealth of nations. The lessons of Turgot and Smith. Jean-Jacques Pluchart *see review on AI and intellectual property

The Legacy of Turgot: Turgot’s Lessons

When one rereads the economic history of France, it seems that in every era, a voice has reminded us of the same simple truths: one must not spend what one does not have, one must not play with money, and one cannot build prosperity on promises or wagers. Turgot, Jacques Rueff, and Jean-Marc Daniel embodied this fidelity to reality. Each, in his own century, defended the idea that balancing public finances is not a constraint but a condition of freedom. Their legacy has endured through time, tracing a red thread from the eighteenth century to the present day. Turgot: Rigor as a Starting Point When Turgot was appointed Controller-General of Finances, he found a state in fiscal disorder. He rejected privileges and denounced waste. His guiding principle can be found in his Reflections on the Formation and Distribution of Wealth (1766), where he wrote: “We do not create wealth by distributing what we do not have.” This sentence, often quoted, expresses more a philosophy than an economic theory: rigor is not an accounting obsession, it is a moral requirement. For him, a deficit is an injustice passed on to future generations. In a France bogged down by rents and privileges, he defended the freedom to work, the free circulation of grain, and the abolition of forced labor. Jacques Rueff: The Guardian of Monetary Truth A century and a half later, Jacques Rueff took up the torch. He too lived in a world of illusions — those of a misinterpreted Keynesianism and of deficit financing through monetary creation. Alongside General de Gaulle, he helped lead the 1958 fiscal recovery of the French economy. For him, public debt was not just a number but a political fault. In The Social Order, he wrote: “No order can be built by defying the natural laws of the economy.” Budgetary balance, in his eyes, was an instrument of sovereignty: every deficit, every indulgence, led to dependency. He saw money as a moral instrument before being a financial one. In The Relentless Problem of Balance of Payments, he extended Turgot’s spirit: without fiscal discipline, there can be no lasting freedom. Rueff rejected fatalism. In Unemployment and Money, he demonstrated that unemployment results from accumulated rigidities. He advocated greater labor-market flexibility and the defense of free competition. Jean-Marc Daniel: Growth Through Freedom and Responsibility Jean-Marc Daniel stands in this same lineage. A liberal economist, he rebukes Keynesian complacency. His work belongs to a globalized, open economy where the temptation of protectionism and public spending remains strong. His intellectual mission: to remind us that sustainable growth rests on four essential pillars — work, saving, freedom (competition), and education. For him, rigor goes hand in hand with pedagogy. The State cannot produce wealth; it can only guarantee the conditions for it: security, justice, education, and monetary stability. Economics, in his eyes, is not a machine — it is a moral order founded on the truth of prices established by free competition and the reward of effort. In this sense, Daniel is a continuator of Turgot and Rueff: he denounces public budgetary excesses and insists that prosperity cannot be decreed — it must be learned. Philippe Aghion: Creative Continuity Philippe Aghion extends this heritage into another dimension — that of innovation. Where Turgot saw rigor as the condition of freedom, and Rueff viewed sound money as the keystone of prosperity, Aghion introduces the discipline of creativity. Inspired by Schumpeter, he formalized creative destruction: progress does not come from a spendthrift state but from a stable framework in which firms are free to innovate, fail, and begin again. Like his predecessors, Aghion does not oppose innovation and rigor — he connects them. Without strong institutions, quality education, and incentives for effort and investment, there can be no lasting progress. In this sense, he continues the spirit of Turgot and Rueff: freeing human energy while maintaining the discipline of rules. He also joins Daniel in emphasizing the importance of knowledge and education. Conclusion From Turgot to Rueff, from Daniel to Aghion, four voices, four centuries, one lesson: discipline — whether fiscal, monetary, or intellectual — is not optional; it is a political necessity. Economic disorder always prepares social disorder and, ultimately, leads to servitude, while rigor opens the path to freedom. Turgot’s thought has endured because it is rooted in reality and rejects illusions. Its legacy endures because success does not lie in mortgaging the future but in giving it every chance to exist free of servitude. To reread Turgot, Rueff, Daniel, and Aghion is not to yield to nostalgia; it is to rediscover, beneath today’s debates, the keys to lasting prosperity. Benoit Frayer November 2025 References Anne-Robert Jacques Turgot, Reflections on the Formation and Distribution of Wealth (1766). Jacques Rueff, The Social Order (1945); The Relentless Problem of Balance of Payments (1965); Unemployment and Money (1931). Jean-Marc Daniel, Capitalism and Its Enemies (2016); The Collusive State (2014); A Living History of Economic Thought (2018). Philippe Aghion, The Power of Creative Destruction (with Céline Antonin and Simon Bunel, 2020); Endogenous Growth Theory (with Peter Howitt, 2008). Joseph Schumpeter, Capitalism, Socialism and Democracy (1942) — theoretical foundation of “creative destruction,” later extended by Aghion. Benoit Frayer November 2025

Digital economy and violence in the workplace

Jean-Jacques Pluchart The digital economy, and in particular Artificial Intelligence, are often presented as freeing the worker from the most alienating tasks in favor of more creative actions, but they are also perceived as being able to generate a loss of meaning of action, professional malaise and violence at work. In the context of an organization, violence can take many forms: verbal and physical, psychological and social, symbolic and structural, which differ according to multiple factors: the activity carried out, the work situation, gender, but also according to the systems implemented, as in the case of digital technologies covering automation and expert systems, the Internet and social networks, symbolic and generative AI applications. Violence can be exercised between the actors themselves (between colleagues, between superiors and subordinates) and/or between the latter and the stakeholders (customers, users, suppliers, etc.) of the company or the administration, but it can also be caused by a procedure or a system. The most frequently cited form of violence against workers generated by AI is the fear of losing one’s job and thus being socially downgraded, or of having to adapt to a new job that is said to be “augmented” by AI. The future “robot-man” fears, in particular, being confronted with the ingratitude and loneliness of a job carried out remotely, alone in front of a screen, prey to the dysfunctions and “black boxes” of a system, and most often subjected to digital panoptism. They fear losing the meaning of their work, no longer recognizing their symbolic order, no longer knowing their professional identity. He fears being exposed to the stress and burnout of the ‘enslaved man’. This anxiety can be all the more depressive as he can no longer activate his defense systems (by denial, displacement, derision, sublimation…) against a “robot” whose grip is inevitable. The violence of this new relationship to work is all the more implicit as it is marked by the uncertainty weighing on the date and conditions of the implementation of the new system thus perceived as a ‘black swan’. The threat is all the more latent as it covers a growing number of jobs, ranging from back office (administration) to middle office (production and control) and front office (customer relations, etc.). It now reaches managers and executives responsible for reorganizing a company or a service, arbitrating between often complex operating systems, ensuring their cyber security and training staff in new practices. They are thus exposed to new types of risks to the sustainability of their organizations and to the future of their own careers. These incomplete observations show that the forms of violence at work generated by the accelerated development of AI can only be detected, analyzed and framed by HRM approaches using psychology and sociology, but also anthropology and psychoanalysis.

Understanding with Turgot at what level the interest rate is established

Anne Robert Jacques Turgot Chronique de François MeunierTurgot had said almost everything as early as 1766, ten years before Adam Smith, about the formation of the interest rate and its relationship with the return on capital and the price of fixed-income financial securities. This is in his major economic work: “Reflections on the Formation and Distribution of Wealth .” In particular, three concepts that are not simple to understand or to make understood. 1. That the rate of return or cost of capital (depending on whether we take the point of view of the investor or the company) depends on the associated risk. The interest rate (which ensures a fixed income, independent of the profitability of the investment except in the event of default) must then be lower. (Underlining and brackets are from the author)I have counted five different ways to use capital or to invest it in a profitable way. The first is to buy land that yields a certain income. The second is to invest one’s money in agricultural enterprises by leasing land whose fruits must yield, in addition to the price of the rent, the interest on the advances and the price of the labor of the person who devotes his wealth and his effort to cultivating them. The third is to invest one’s capital in industrial and manufacturing enterprises. The fourth is to invest it in commercial enterprises. And the fifth, to lend it to those who need it, for an interest. […] It is obvious that the annual products that can be withdrawn from the capital invested in these different jobs are limited by each other, and all relative to the current rate of interest on money. • LXXXIV. — Money invested in land must yield less. Anyone who invests their money by buying land leased to a well-paying farmer obtains an income that gives them very little trouble to receive, and that they can spend in the most pleasant way by giving a career to all their tastes. It also has the advantage that land is the most secure possession against all kinds of accidents .• LXXXV. — Money lent must yield a little more than the income of land acquired with equal capital. He who lends his money at interest enjoys even more peacefully and more freely than the landowner; but the insolvency of his debtor can cause him to lose his capital. He will therefore not be satisfied with an interest equal to the income of the land he would buy with the same capital. The interest of the money lent must therefore be stronger than the income of land purchased for the same capital, because if the lender were to buy land of equal income, he would prefer this use.• LXXXVI. — Money invested in agricultural, manufacturing, and commercial enterprises must yield more than the interest on money lent. For a similar reason, money employed in industry or commerce must yield a more considerable profit than the income of the same capital employed in land or the interest of the same money lent; for these employments require, in addition to the capital advanced, a great deal of care and work, and if they were not lucrative, it would be much better to obtain an equal income that could be enjoyed without doing anything. […] 2. That the costs of capital are interrelated, in a proportion that depends on the risk. An increase in the cost of capital causes an increase in the interest rate, through an arbitrage relationship. In modern terms, this resembles the CAPM. • LXXXVII. — However, the products of these different uses are limited by each other and are maintained despite their inequality in a kind of equilibrium. The different uses of capital therefore yield very unequal products; but this inequality does not prevent them from reciprocally influencing each other, and from establishing a kind of balance between them. […] I suppose that suddenly a very large number of landowners want to sell their land: it is obvious that the price of land will fall, and that with a smaller sum one will acquire a greater income. This cannot happen without the interest of money becoming higher; for the owners of money will prefer to buy land than to lend it at an interest that would not be stronger than the income of the land they would buy. So if borrowers want to have money, they will be forced to pay a higher rent. If the interest of money becomes higher, it will be better to lend it than to assert it, in a more painful and risky way, in the enterprises of culture, industry and commerce, and we will only do business with those who will bring, in addition to the wages of labor, a much greater profit than the rate of money lent.In short, as soon as the profits resulting from any employment increase or decrease, capital is poured into it by withdrawing from other employments, or is withdrawn from it by pouring into other employments; which necessarily changes the ratio of capital to annual product in each of these employments. […] The product of money used in any way whatsoever cannot increase or decrease without all other uses experiencing a proportionate increase or decrease. 3. Finally, the price of annuities or fixed-income bonds is inversely related to the interest rate. LXXXVIII. — The current interest rate of money is the thermometer of the abundance or scarcity of capital; it measures the extent that a nation can give to its cultural, manufacturing and commercial enterprises. […] It is obvious that the lower the interest on money, the more valuable the land. A man who has fifty thousand pounds of annuities, if the land is only sold at twenty [i.e., with a P/E of 20X or a rate of return of 5%], has only a wealth of one million; he has two million if the land is sold at forty [a P/E of 40X]. If the

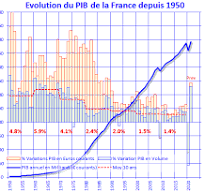

The GDP in question

On September 12, Fitch downgraded France’s sovereign debt from AA- (high quality) to A+ (upper average quality). In its analysis, the agency uses GDP as a central indicator to assess the sustainability of public finances, in particular through the debt/GDP ratio. Fitch points out that French public debt is expected to rise from 113.2% of GDP in 2024 to 121% in 2027, with no clear prospect of stabilization. Fitch considers it unlikely that France will bring its public deficit below 3% of GDP by 2029, while the government was aiming for this objective to comply with European rules. The deficit is expected to be 5.4% of GDP in 2025, and should remain above 5% in 2026 and 2027. In this context, the agency believes that France has less room for maneuver in the face of possible economic shocks. According to the latest INSEE estimates, the country’s GDP will grow by 0.8% in 2025 instead of the 0.6% initially forecast, due to better dynamics in agriculture, tourism, the real estate market, and aeronautics. This increase, although positive, is far from expected to offset the weight of the debt. In its latest economic bulletin published on September 25, the ECB presents an overview of the macroeconomic projections of inflation and GDP in the Eurozone, in order to justify its monetary policy. Inflation is expected to be 2.1% in 2025, 1.7% in 2026, and 1.9% in 2027. Growth, meanwhile, is expected to be 1.2% in 2025, 1% in 2026, and 1.3% in 2027. In its statement, “the Governing Council considers it essential to strengthen, without delay, the eurozone and its economy in the current geopolitical environment. Fiscal and structural policies should improve the productivity, competitiveness and resilience of the economy… It is up to governments to prioritize structural reforms and strategic investments that promote growth while ensuring the sustainability of public finances.”The roadmap is therefore clear: GDP must be supported However, is the calculation of GDP still relevant and up-to-date to measure the wealth created by a country? Should its formula evolve as suggested by some economists and politicians? And especially in terms of climate change? GDP is already 80 years old It was at the Bretton Woods conference in 1944 that GDP was adopted as a standard indicator to measure the economic activity of countries, in particular to facilitate international comparisons and post-war reconstruction. It will thus be gradually adopted by the whole world and international organizations, such as the UN, the IMF or the World Bank. In France, it was applied from 1949. Over the years, GDP gradually replaced GNP (Gross National Product) as the main indicator, because it measures production in a territory, regardless of the nationality of the economic actors. In the 70s and 80s, GDP began to include previously neglected sectors such as services. Indeed, developed countries are moving from an industrial economy to a service economy, which changes the structure of GDP The limits of GDP In 2009, the Stiglitz-Sen-Fitoussi report or the “Report on the measurement of economic performance and social progress” was commissioned by Nicolas Sarkozy. Questioning the limits of the calculation of the indicator, this report proposes to supplement the GDP with indicators of well-being, sustainability and inequalities. Indeed, the report points out that GDP: – ignores well-being: it does not measure happiness, health, education, or the quality of the environment;– neglects inequalities: an increase in GDP can hide an increase in income gaps. It ignores sustainability: It does not take into account the degradation of natural capital (resources, climate);– does not value unpaid work, such as volunteering or domestic work.Recently, the ECB also warned its member states that climate change could cut European GDP by 5% by 2030. In France, INSEE proposed in 2024 a complementary indicator to GDP, the “adjusted net domestic product” (Pina): this indicator makes it possible to take climate change into account by netting the creation of value from the effects of future damage and decarbonization costs. Although developments are being studied and considered, GDP is still the reference for a large number of institutions as a management tool; but other dimensions of analysis will have to be added in order to have a more global vision in a context of global warming. Sophie Friot Member of the Turgot Club

The gray areas of financial and extra-financial communication

Part 2: New Approaches The manipulations observed in the social accounts and the sustainability reports of the companies are generally explained by models derived from the “Cressey triangle” or by the psychological biases analyzed by Kahneman and Sversky. But new approaches borrowed from phenomenology and psychoanalysis now allow to explain the development of managerial practices in “gray areas”. Traditional approaches Fraud covers intentional behavior contrary to laws, regulations, and financial, social, and environmental standards. It has been the subject of much research since the founding work of Sutherland, author of the famous “white collar crime” formula. The reference model applied to its various practices is that of the “fraud triangle”, proposed by Cressey (1967), according to which the fraud process develops along three axes: – “The opportunity” to commit an illegal act and/or contrary to the interests of an organization, which is often offered by privileged access to sensitive resources (data, systems, bank accounts …) insufficiently protected. – The “motivation” of the fraudster, which covers different types of psychological bias and psychic affects: the need for money, the quest for recognition, ambition, the taste for risk, mimicry, addiction to fraud. – The “rationalization” of the fraudster’s behavior, which corresponds to the practices of adverse selection intended to mask the fraudulent acts and to thwart the confidence of third parties, in particular by accounting concealments, which reflect the “excuses” that the fraudster gives to himself: “he only borrows the money”; “He falsifies the accounts to save the company”. Cressey’s model has been adapted to new forms of management. Albecht (1982) distinguished three factors favorable to fraud: environmental pressure, opportunism, and the psychological profile of the fraudster. Rezaee (2002) designed the “3C model” (Choice, Conditions and Corporate Framework). Bealey (2000) observed the internal contingencies (the history of the company) and external (its institutional framework) of the fraud process. The Statement of Auditing Standards classified 25 different factors of corporate fraud risk, according to 3 axes: the personalities of the leaders, the economic environment of the company and its organization. The Cressey triangle was reinterpreted by Dominey et al. (2012), who propose a model no longer focusing on the fraudster but on his practices. Called the “fraudulent act triangle model”, it also has three facets: a more or less sophisticated methodology (a misappropriation of assets, a transfer of liabilities…), a concealment of fraud (a false accounting entry, a file destruction…), a conversion of the proceeds of fraud into exploitable assets (money laundering). According to Smith and Lewis (2011), corporate accounting manipulations are generated by managerial drifts based on four types of paradoxes: – organizing paradoxes, which occur when groups of actors oppose methods (accounting-real, fraudulent-non-fraudulent); – belonging paradoxes, which arise when a goal can be achieved by different means (accounting-real), or when there are conflicting goals (short or long term); – performing paradoxes, which arise from more or less conflicting interests between stakeholders; – learning paradoxes between tradition and innovation, which result in a “phygital” treatment (combining experience and algorithms) of accounting manipulations. According to Boudon (1990), fraud or manipulation has become a social phenomenon marked by “mimicry effects” and “composition effects”, by which interactions between the types of actors (intentional and unintentional manipulators, fraudsters and non-fraudsters) lead to perverse effects contrary to the intentions of each. According to Tversky and Kahneman (1974), the behaviors of corporate actors are subject to four classes of bias that have been reinforced by the development of Artificial Intelligence and that particularly affect communication to meet ESG principles. The first class covers cognitive biases that distort the processed data, their processing models, and the interpretation of the results, including familiarity and confirmation biases. Faced with an urgent decision or a complex problem, managers choose the option they think they can best control or the solution that mobilizes immediately available resources and/or involves easily controllable issues. They are also subject to biases of “conservatism” which reflect the tendency to overestimate information in line with their convictions (Festinger, 1957), or anchoring biases, which consist in discarding discordant or confusing information and to seek only those confirming their own choices (Goetzman and Pelès, 1997). The second class of heuristics transposable to AI deals with excesses of optimism and confidence. Managers tend to interpret the “solutions” provided by the applications as “self-fulfilling discourses” or “performative presentations”, which give them the illusion of controlling the situation. They are victims of overconfidence, usually accompanied by self-justification in the event of a bad decision. The decision-maker has the illusion that they “manage in compliance”, that they “master the ESG criteria”, that they “inspire the confidence of their stakeholders” … They believe they do not need advice; they rationalize past events a posteriori (retrospective bias); they attribute all the merits of a success (self-attribution bias), according to Roll (1986) … The third form of bias relates to the effects of imitation or conformity, which affect, according to Hong, Kubik and Stein (1994), designers influenced by socio-professional norms, or by the follow-up of pioneers, charismatic leaders or events. The fourth form of drift caused by generative AI covers perceptual and/or emotional biases, which can blur the mental representation of a phenomenon (Higgs, Dulewicz, 2002). Certain ambiguous or counter-intuitive solutions revealed by AI can induce different behaviors from one actor to another in the face of identical situations. These biases can distort individual decisions in business. Loewenstein et al. (2001) have shown that the fear of an uncertain event is often motivated by the possibility – and not the probability – of its negative consequences; because the more “the latter are perceived as important, the more the affective prevails over the cognitive”. The respondents’ answers (presented in the section make it possible to distinguish three new approaches to gray areas within organizations, which have not yet been proposed – or which have only been mentioned – by researchers and experts on the issue of gray areas in management. This exploratory survey makes it possible to go beyond the traditional approaches, according to which (non-fraudulent) manipulations in

The gray areas of financial and extra-financial communication (1)

Jean-Jacques Pluchart The research workshop organized on June 27, 2025 by the Institute of Psychoanalysis and Management (IPM), an academic association member of the FNEGE, gave rise to several communications on the theme of “gray areas of the management of organizations”. Professor J-J. Pluchart (Scientific Director of the IPM) presented research on the gray areas of financial and extra-financial communication, the results of which are likely to interest the readers of clubturgot.com. Since its inception, financial accounting has given rise to various frauds contrary to the regulations and standards in force, to which have recently been added so-called “creative” practices apparently aligned with an accounting framework, but in fact not in accordance with the ethics of the company. These behaviors are part of the “gray areas” of management, located on the border between the regulatory and non-regulatory domains. These practices have diversified with the obligation to publish sustainability reports, which requires the reporting of several hundred extra-financial indicators, both accounting and statistical, as part of ESG (Environment, Social, Governance) reporting. The accounting gray area has thus extended to practices relating to green and social washing, nudging, faking, etc. These deviations have been facilitated by certain applications – so-called projective – of Artificial Intelligence. The research, based on a questionnaire survey of a population of statutory auditors and trusted third parties, identified common practices observed in the grey areas covering accounting and sustainability reporting, as well as analyzing the motivations of their authors. The panel surveyed distinguishes between fraudulent manipulations contrary to regulations, which are a priori in “black areas”, and non-fraudulent manipulations contrary to professional ethics or company ethics, which constitute “gray areas”. The discriminating criterion that dominates the auditors’ responses is compliance or non-compliance with laws, regulations, and professional standards. Accounting and Extra-Accounting Practices The respondents distinguish: – Accounting fraud (“black areas”), such as the recording of fictitious transactions (sales, purchases, movements of stocks, receipts or disbursements…) and the issuance of false invoices; the non-recognition or recording of actual transactions that do not comply with IFRS standards (such as the activation of advertising or training costs); the falsification of accounting documents (invoices, contracts, certificates, labels…), the deconsolidation of subsidiaries in debt and/or in deficit; the failure to publish the company’s accounts or the publication of only pro-forma accounts; the early recording of income or delayed expenses from one year to the next… – Non-fraudulent accounting manipulations, such as the adjustment of discretionary accruals (optional allocations or reinstatements of depreciation and provisions) and/or the need for working capital; the application of the big bath technique during a change of management, by exceptional allocations of provisions that can be reinstated in the following years; the smoothing of results over several years in order to maintain a regular distribution of dividends, and/or to display results in line with forecasts; the change in the inventory valuation method in order to generate capital gains or losses; the activation of certain expenses (R & D, interest …) and their amortization over several years; the revaluation of certain assets (real estate, goodwill …) using models generating capital gains or losses (also cited by Chiapello, 2005); the unusual use of factoring or discounting to improve cash flow; the non-publication or partial publication of accounting results despite the risk of legal proceedings; the publication of “oriented” pro-forma results, in order to influence the course of the action; the manipulation of segmented information to guide comparisons between competitors in the same industry … – “Real accounting manipulations” (creative accounting), such as the artificial increase in sales through excessive year-end discounts and/or exceptionally favorable invoice payment terms; the deferral of expenses from one year to the next (including research and development and/or training expenses); the realization of lease back operations of various assets (headquarters, stores, warehouses, factories, equipment, etc.); the abnormal disposal of non-operating and/or investment assets… – Extra-financial manipulations, such as in black areas, non-compliant practices of disinformation, qualified as environmental (green washing) and social or societal (social washing) laundering, covering erroneous, imprecise or truncated data; in gray areas, non-information (some key data are omitted) or non-monitored information (companies display objectives but not results), and the biased framing of the company’s projects or operations: – over time, with simulations and projections (facilitated by AI) to present the most favorable or most credible data (such as net-zero or very long-term gender parity objectives without regular monitoring of achievements); – in space, with data (also processed using AI) not representative of a field, due to intentional targeting errors and/or biased parameters, ambiguities or textual inconsistencies, which lead to errors in data interpretation. Factors favorable to gray areas Overall, the auditors interviewed believe that it is increasingly difficult to isolate the types of more or less fraudulent manipulations, insofar as a growing number of them (misappropriation of assets, fraud in purchases or overheads, etc.) are internal or external while benefiting from internal complicity, and are the subject of increasingly difficult to detect hedging manipulations. Manipulations that are deemed to be in gray areas by auditors and ICOs (Informative Commissionner Officers), are generally observed when: – the company is over-indebted, its results are declining, its stock price is volatile and/or the continuity of its operations is threatened; – conflicts of interest between the company’s stakeholders (in particular between investors, partners, staff, the State, etc.); – the company’s shareholding is open and fragmented; the smoothing of the company’s results reassures its stakeholders about the company’s resilience; – the company’s image is less likely to be degraded if it complies with accounting rules but not or little with ESG standards, which are more recent and uncertain. According to the respondents, some managers therefore justify their intentions and behaviors by: – “good reasons”: the difficult or particular situation of the company justifies a “certain interpretation” of the rules and standards; – “professional routines”: “accountants have always practiced accounting and tax optimization, the new standard is inapplicable…” – “beliefs”: “non-information makes it possible to avoid green or social bashings; the superiority of the shareholder model, innovation

European industrial policies relaunched by the American isolationist shift

Jean-Jacques Pluchart By favoring competition, the Council and the Commission of the European Union have not engaged in a real industrial strategy in most sectors of activity, and in particular in those of production and electric mobility. This gap is revealed in particular by the new industrial ambitions displayed in these areas by the United States and China. The policy of technological neutrality applied by the 27 EU governments highlights their differences on the fundamental subject of the industrial competitiveness of the Old Continent. EU leaders have set mainly environmental objectives in certain sectors, without adequate regulation and financing. Thus, from 2020, the desired sharp reduction in CO₂ emissions has forced manufacturers to urgently convert to electric mobility, without sufficient mastery of technologies (particularly hybrids), sources of supply (batteries), recharging infrastructures, dedicated financing, accounting frameworks and training channels. In the absence of concerted directives, European car manufacturers have favored the production of high-end electric vehicles with very mixed success, while Chinese manufacturers have embarked on the mass production of small electric vehicles. It seems that the Parliament lacks industrial culture and the European Commission lacks experts capable of controlling the manufacturers’ lobbies. The “Draghi report”, made public in September 2024, denounced the European deficit of competitiveness over the United States and China in several key industrial sectors. The report recommends stimulating innovation, particularly in the field of artificial intelligence. It estimates the cumulative investment to be made over 10 years at €800 billion… the same amount as that allocated to defence by the “Rearm plan”. The “Draghi report” also proposed the launch of a joint plan for the decarbonization of industrial activities, security of supply and a reduction in Europe’s dependence on critical resources. The report extends its recommendations in particular to the hydrogen, space launchers and micro-nuclear sectors. It appeals to Europeans’ economic patriotism and urges them to overcome their divisions in the face of the pooling of sensitive resources, the orientation of investments and the taking of protectionist measures (in particular through ecological standards). But there are still some weak signals. Directly confronted with Chinese competition in the automotive sector, Germany has recently questioned its dogma of budgetary austerity, and has shown its willingness to build a sector dedicated to electric mobility. France anticipated this movement by committing in October 2021 to its “France 2030” plan, the objective of which is to strengthen the country’s industrial and technological sovereignty. With an investment envelope of €54 billion (half of which is dedicated to SMEs), this plan sets 10 objectives and activates 6 levers to support the transformation of the French economy, focusing on sectors of the future such as digital, hydrogen, batteries, space, health and decarbonisation. 14 of the 16 indicators are in line with the set trajectory. By the end of 2024, funding has supported 7,457 projects, 6,103 patent applications, and mobilized 196,824 jobs, including 156,009 jobs after project implementation, demonstrating their lasting impact. Several results have been made public in terms of GHG emissions, bio-drugs, new modes of transport, the electronics industry, robotics, new materials, quantum computers, hydrogen development and training in new technologies. The “France 2030” plan also aims to ensure the emergence, industrialization and growth of start-ups. More than €7 billion in aid has been allocated to support 925 projects and finance 130 venture capital funds by early 2025. However, as in most other European countries, the continued implementation of this plan involves harmonizing and simplifying the regulatory, financial and tax frameworks. Will Europe seize the opportunity offered by the global geopolitical reconfiguration initiated by the United States? The European Union has long favored a policy of competition rather than a real industrial strategy, which has left continental manufacturers relatively unarmed in the face of competitors benefiting from stronger state support. The difficulties of the electric transition, political hesitations, the lack of clarity of European directives and the need to develop a strong European industrial sector, including battery production, are the challenges ahead for the European electric mobility industry. Moreover, this is in an immediate context of great uncertainty related to recent announcements by President Trump. If Europe has in the past and until very recently refused to assume a strategic role to guide the development of a competitive industrial sector along the entire value chain of electric vehicles, as is happening in Asia and the United States, the situation may be changing. Especially under the German impulse. Bernard Julien is a lecturer in economics at the University of Bordeaux. Director of the Permanent Study and Research on the Industry and the Employees of the Automobile (Gerpisa) until 2015, he then founded a research firm, FERIA, dedicated to training, research and studies on the automotive industry. He explained to Techniques de l’Ingénieur the difficulty for Europe to assume a real industrial policy in the automotive field, and how this state of affairs could evolve with the current period. Techniques de l’Ingénieur: Can we really talk about a European industrial policy in the automotive sector? Bernard Julien: Not really. Historically, Europe has never implemented an explicit industrial policy for the automobile. More generally, Europe has never even implemented an industrial policy worthy of the name. Brussels has instead relied on a liberal vision, in the sense that the European institutions have allowed both competition to take its course between large European firms, and the industrialists themselves to decide their technological orientations.

France’s Digital Inclusion Plan

By Jean-Jacques Pluchart In April 2025, the National Productivity Council (CNP) published its 5th report entitled “A Changing World – Productivity, Competitiveness and Digital Transition”, which presents the opportunities offered to the French economy by a better contribution of digital technology. The report is structured in 3 parts: the evolution of productivity, the relative competitiveness of the country and the impact of new technologies on growth. Established in 2018, the CNP, chaired by Natacha Valla and reporting to France Strategy, is responsible for advising the government on economic policies related to productivity, assessing their effects and feeding the public debate. It shows that the ongoing transformations of the French economy are divided between short-term objectives and long-term structural imperatives. The experts note that in France, current labor productivity per capita is 5.9% below its pre-Covid level. Two-thirds of this drop in productivity over 5 years can be explained by transitory factors: apprenticeships, job retention in sectors facing a decline in activity, effects of workforce composition (higher proportion of lower-skilled jobs, etc.). The remaining third is due to a structural weakening of productivity in Europe. This lack of dynamism can only be stemmed by new investments – particularly in digital technology – and by a transformation of the production system. Employment growth alone cannot ensure the sustainability of economic growth. The report points to the still ambiguous role of digital technologies – notably GenAI and robotics – in the evolution of productivity. Their overall impact is perceived as insufficient in France, but there are indications that a catch-up is possible, provided that AI is more widely implemented in labor-intensive sectors and that workers are rapidly retrained. The report reveals that around 14 million French people, or 28% of the population, are not digitally literate, which is a real handicap in a context of increasing digitization of the world’s population. The experts estimate that a 10-year plan to digitalize 4.7 million French people could generate annual gains of 1.6 billion euros, in the fields of the digital economy, employment and training, relations with public services, social inclusion and well-being. The first area is the digital economy, which includes online purchasing and the collaborative economy. Developing the online purchasing capabilities of a third of the target population, via collaborative economy platforms, could generate purchasing power gains of around €450 million a year. The second area concerns employment and training. Overall, Internet use has a positive impact on the educational success and qualification levels of the French population. This would generate annual savings of around 130 million euros. The third area is the relationship with public services, and in particular online administrative procedures. A digital inclusion plan would generate annual savings of 150 million euros. Fortunately, the latest indicators show some improvement in European competitiveness, particularly in manufacturing. In 2023 and 2024, the reduction in France’s trade deficit was accompanied by a recovery in its export market share. Competitiveness has also benefited from a relative drop in real wage costs. However, overall, French labor costs remain higher than the eurozone average, particularly in countries such as Spain and Italy. Recent cost rises in business services and freight costs could rapidly call into question the gains observed. Non-price competitiveness remains an issue, as French intermediate, investment and consumer products are often perceived as too expensive in relation to their quality. Further increases in labor and transport costs could once again weigh on price competitiveness. France therefore has two strategic choices: to focus on innovation to improve productivity and strengthen non-price competitiveness, or to control labor costs to maintain its competitiveness on international markets. France lags far behind the United States in terms of technological investment, and this deficit could have a lasting impact on potential growth. The Draghi report (2024), which calls for a stronger European framework to stimulate economic growth, is a good example of this. France lags far behind the USA in terms of technological investment, and this deficit could have a lasting impact on potential growth. The Draghi Report (2024), which calls for a stronger European framework to boost competitiveness through innovation (1), underlines this urgency. In the CNP’s view, only a strategy of investment in digital technology, driven by both national industrial policies and European directives, could be one of the levers of tomorrow’s productivity, employment and economic sovereignty. (1) The first effects of the “Draghi report” will be presented in the next blog.

The new forms of economic patriotism

Jean-Jacques Pluchart* Since the accession of Donald Trump to the presidency of the United States, economic patriotism has invited itself into the current debates animating all nation-states. These exchanges reveal not only the polemical nature but also the polysemous nature of the term economic patriotism, often equated with that of economic nationalism. It is true that these notions have been embraced by sometimes opposing schools of thought, and that they still lack a solid scientific foundation. Their perceptions differ according to the political opinions and states of mind of different social groups. Economic patriotism is distinguished from economic nationalism by its nature: the former reflects a rather defensive sentiment (attachment to a country and defense of its economic equilibrium), while the latter covers an offensive ideology (the quest for the economic supremacy of a nation-state). The former enjoys a generally positive image, while the latter suffers from rather negative prejudices, notably inherited from the history of the 20th century. Economic patriotism is therefore a less confrontational concept than economic nationalism. The current resurgence of economic patriotism is mainly driven by the need to rebalance trade balances and alleviate the foreign debts of certain countries, such as the United States and France. In some countries, such as France and Italy, it is justified by the need to reduce unemployment by promoting local production, and to combat inequalities of income and wealth between citizens. It is also explained by consumers’ growing expectations in terms of respect for human rights, public health and environmental protection, which justify their demands for worker protection and product traceability. In Europe, demonstrations in favor of a return to protectionism, deglobalization of trade, relocation of factories, deconsumerism, etc., have been relaunched since the 2000s and relayed by official declarations and reports (notably the Draghi and Carayon reports). On the ideological front, polemics about economic patriotism pit defenders against opponents of free trade, and federalists against sovereignists. Economic patriotism is denounced by the former as provoking “trade wars”, and by the latter as engendering unfair globalization of trade. Some see it as an alternative to the cosmopolitanization of societies and the globalization of economies – which generate unemployment and inequalities in Western countries – while others see it as a factor in the contraction of trade and the slowing of growth of societies and the globalization of economies – generating unemployment and inequalities in Western countries – but represented by others as a factor in the contraction of trade and the slowdown of growth. These debates have been rekindled by the contestation of the latest international trade agreements (such as CETA and TAFTA) and the one-upmanship (the tit for tat theorized by Axelrod) between states, illustrated in particular by the threat to raise US tariffs on Chinese imports, countered by the devaluation of the Chinese yuan. The paradoxes observed in current discourses on trade help to shed light on the nature of contemporary economic patriotism and explain its revival. It responds to the main forces transforming international trade: globalization and the integration of production chains, financialization and the digitization of transactions. It meets the founding criteria – political, social and cultural – of patriotism. It mobilizes all the stakeholders in each nation-state, and concerns its material, immaterial and financial resources. It calls on an ever-expanding arsenal of customs, tax and regulatory practices and instruments, borrowing from hard, soft and rough laws, traditional negotiation methods and social networks. It embraces both state and spontaneous patriotisms, and is a source of great satisfaction to our customers. It draws on an ever-expanding arsenal of customs, tax and regulatory practices and instruments, borrowing from hard, soft and rough laws, traditional negotiation methods and social networks. It encompasses patriotisms that are both state-sponsored and spontaneous, defensive and offensive, flexible and variable-geometry. It requires an appropriation of the territory that combines a global approach with local roots for economic exchanges. It is part of a process of “glocalization” of exchanges, exploiting both global and local resources. It strives to reconcile local, national and universal solidarity. The emergence of new forms of economic patriotism relies on States guaranteeing national sovereignty, citizens respectful of universal values, companies concerned with correcting the negative externalities of their activities, and consumers aware of the effects of their purchasing behavior. Respecting these conditions should help preserve the socio-economic equilibrium of nation-states and the social, societal and environmental of XXI th century. *inspired by J-J. Pluchart, « Les nouvelles formes du patriotisme économique », chapitre in C. de Boissieu et D. Chesneau (dir.), Le patriotisme économique a-t-il un sens aujourd’hui ?, Eds Maxima, novembre 2020.